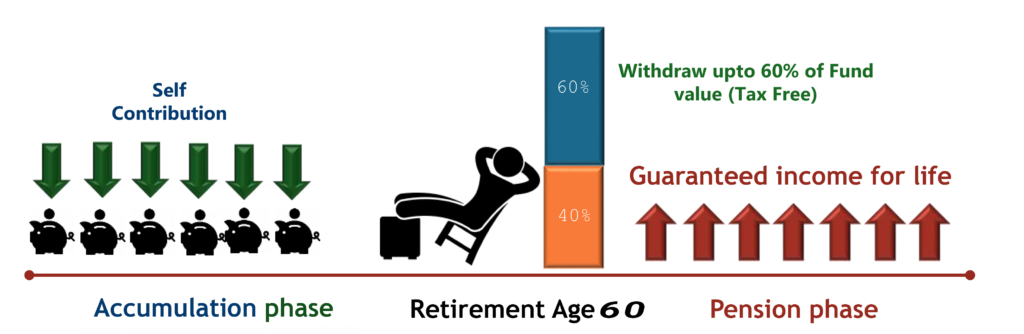

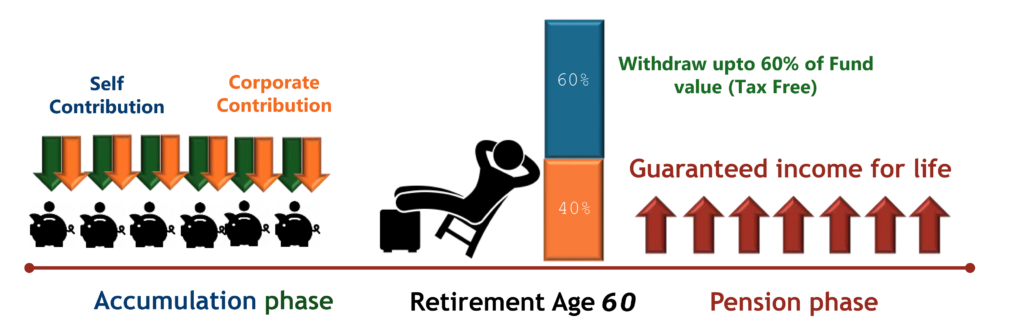

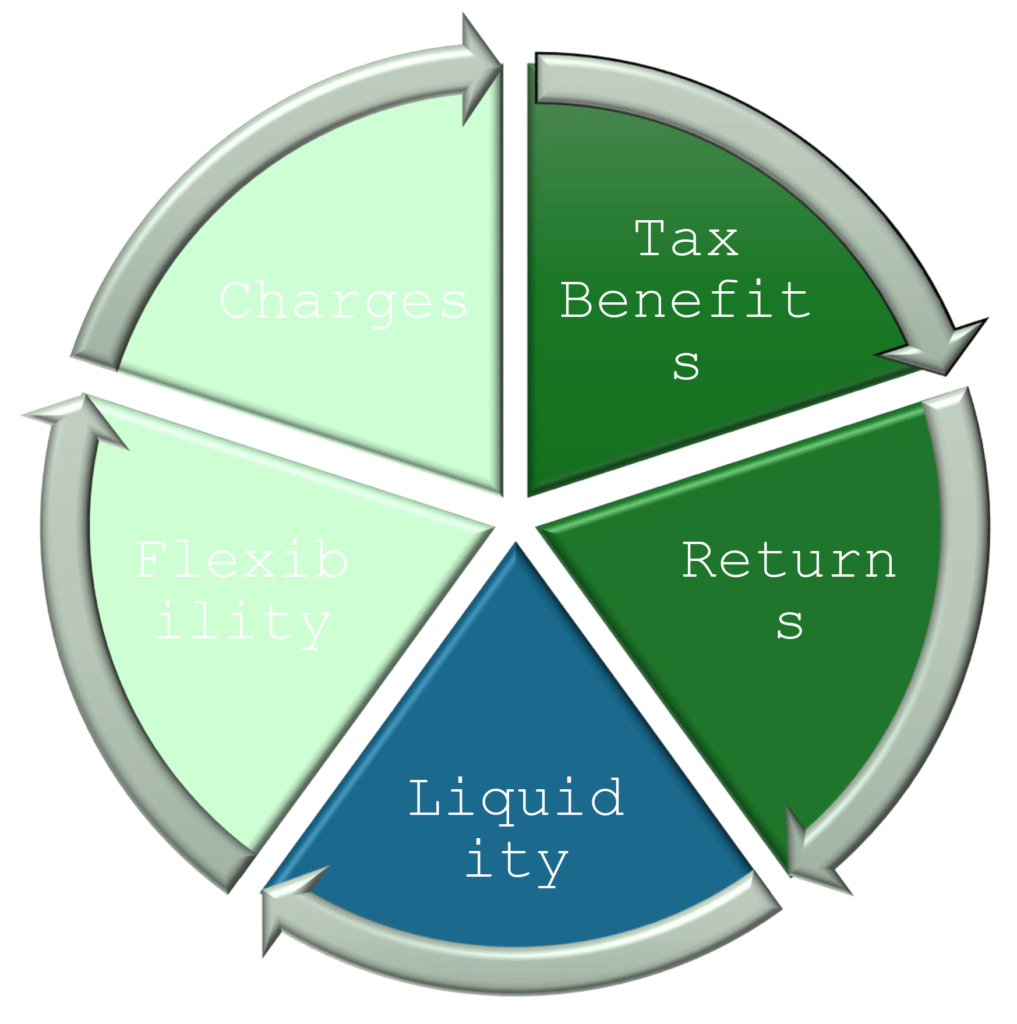

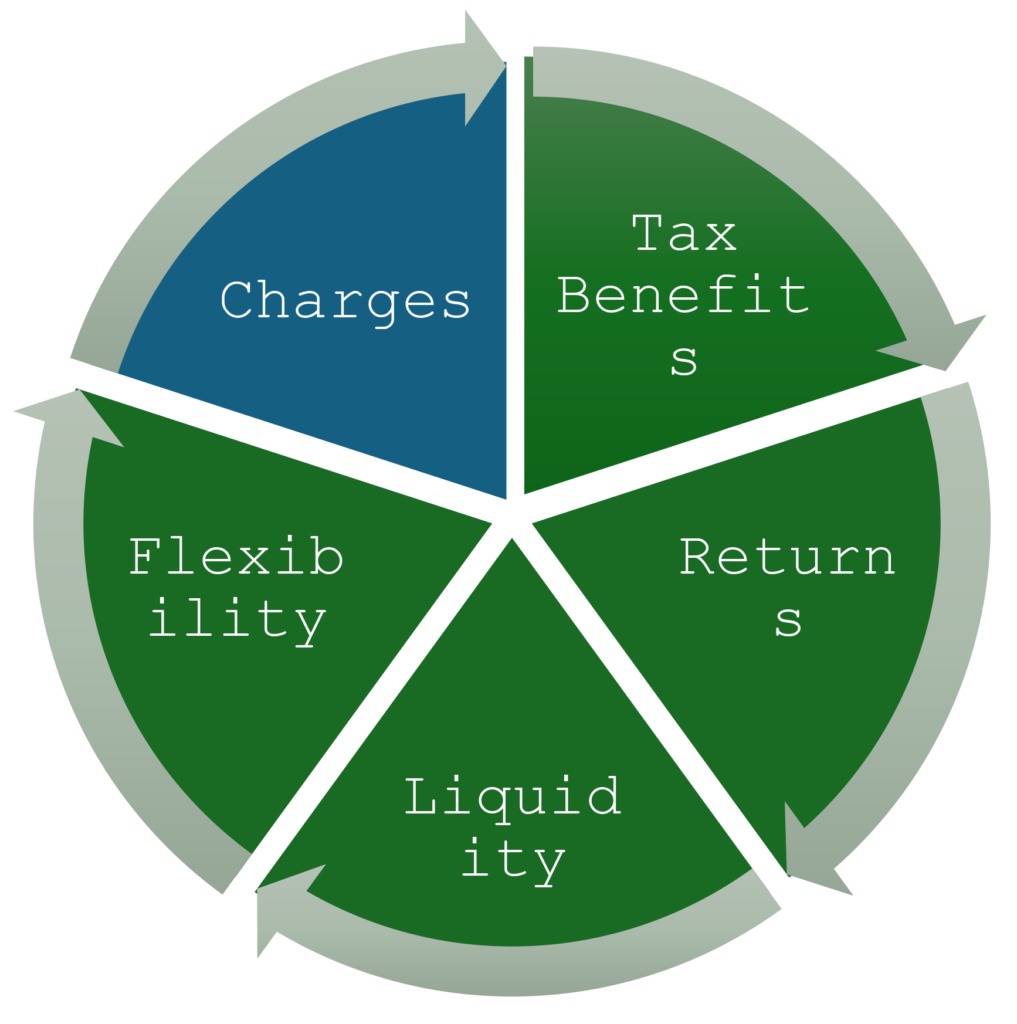

NPS is an easily accessible, low cost, tax-efficient, flexible and portable retirement savings account. Under NPS, the individual contributes to his retirement account and his employer can also co- contribute for the social security/welfare of the individual.

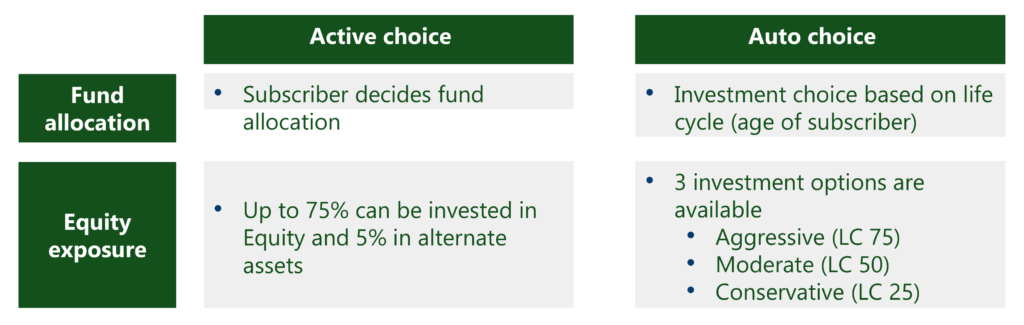

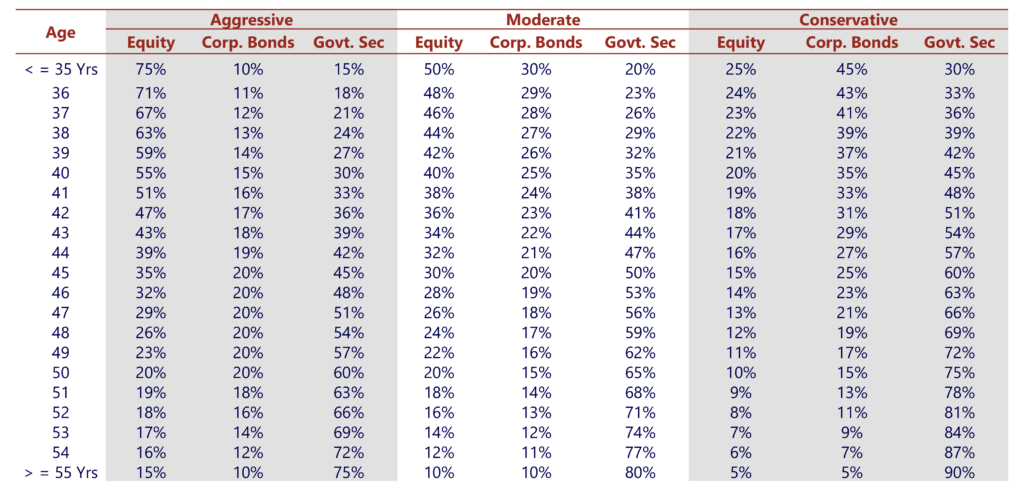

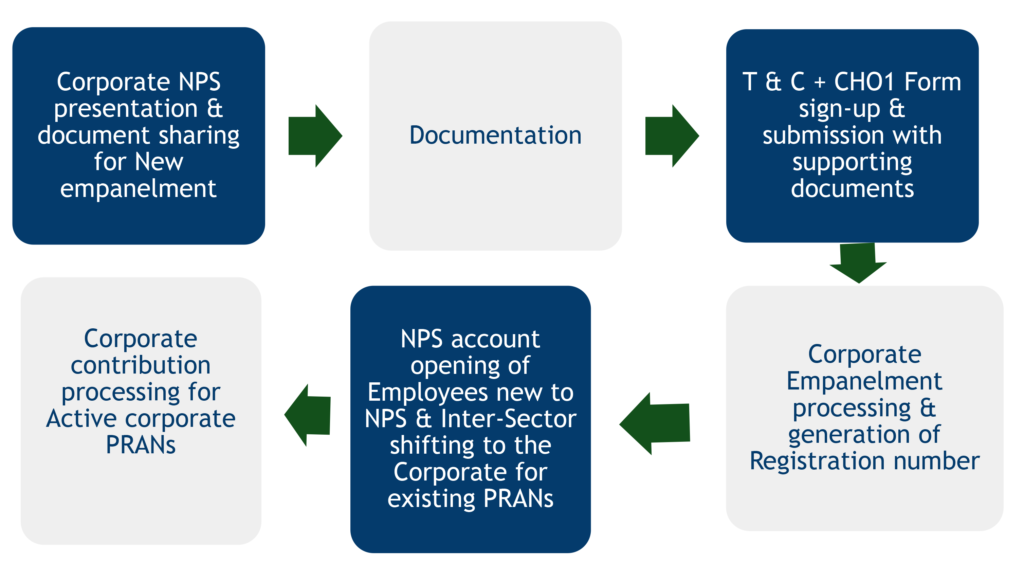

This model is available since 2009

This model was launched in 2011

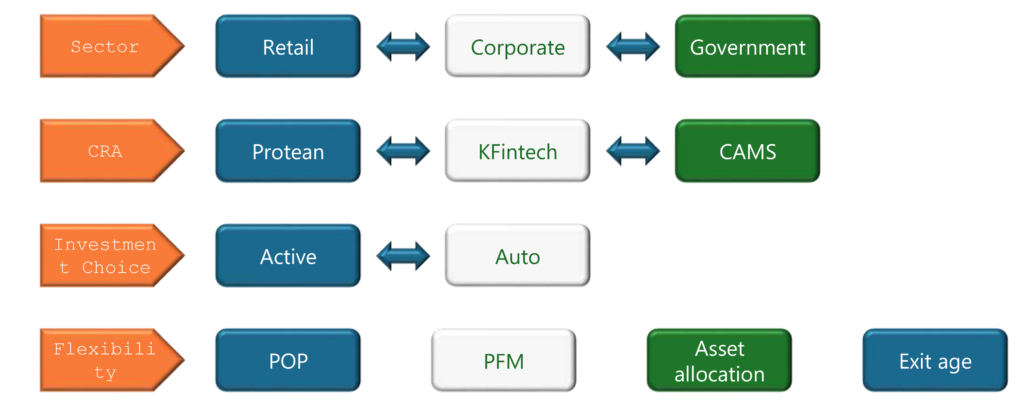

Carry your account across employers, location etc.

Standard product regulated by PFRDA

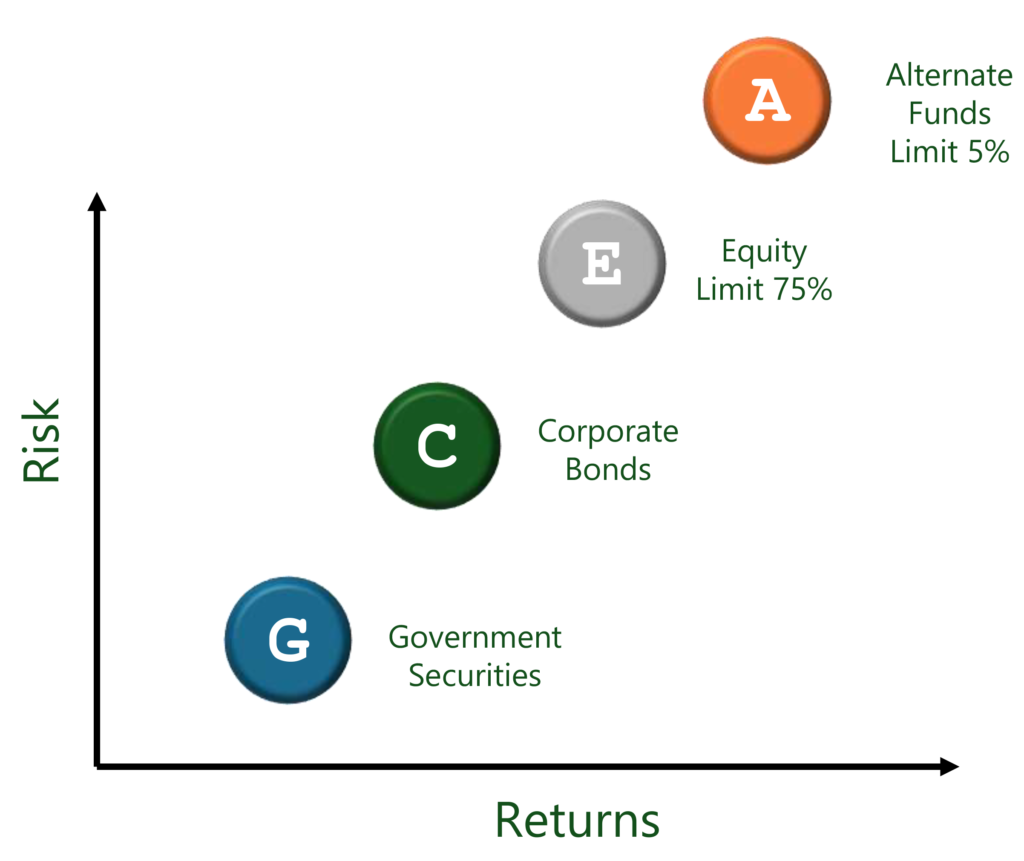

Choose your fund manager, investment option & annuity options

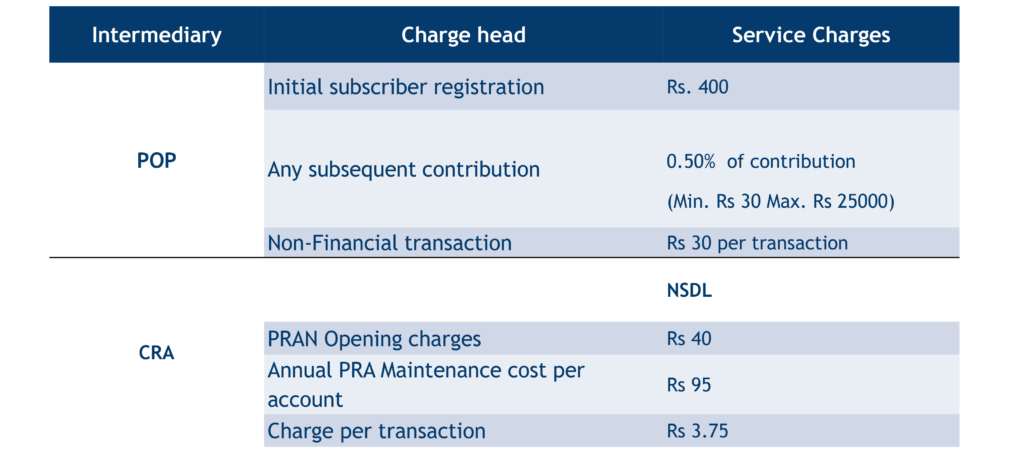

Lowest cost investment product currently available in the market

Still Any Queries?